… Upgrading Life

Our Partners

Provide effective and efficient financial and related service to small producers and especially the unbanked in urban and rural areas

Displaying the highest level of Integrity in the way we conduct our business

Demonstrating a strong Will to Win in the market place

Promoting Diversity in the work place and community

Our team of professionals work closely with client to full fill their needs

Displaying the highest level of Integrity in the way we conduct our business

Harnessing the power of Technology to deliver better customer experience

Setting the standard for the best Corporate Citizenship in the communities we work

Setting the standard for the best Corporate Citizenship in the communities we work

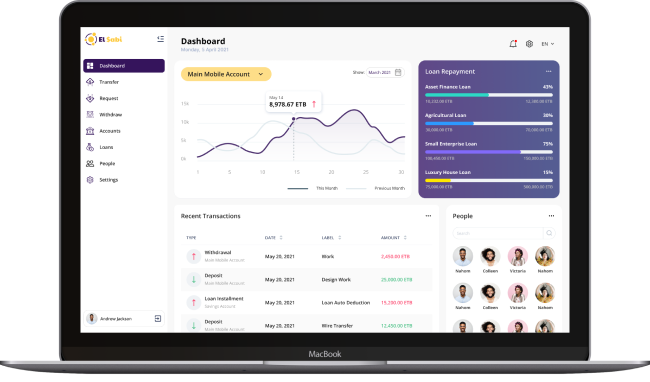

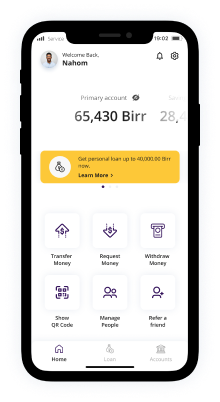

You can use our services using our user friendly mobile and website platform

Our services can be accessed using our Android and IOS application

You can use our online platform to apply for saving and loan accounts

Apply, transfer, withdraw and so on using our USSD service

On premise support on our different branches

Our microfinance institution empowers individuals and communities through microcredits, savings accounts, and support for women and marginalized groups.

We believe in fostering economic independence and sustainable development for small businesses in targeted areas.

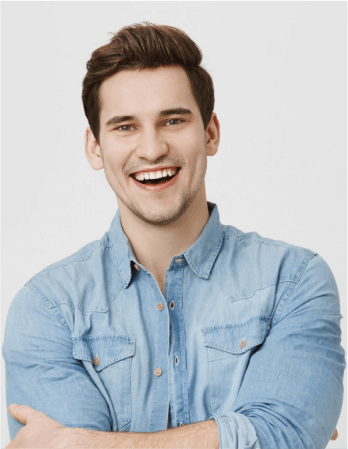

Best service and smooth process. Keep going on Banca team. Thank you for immediate response on each stage of process. Kudos the whole team.

Best service and smooth process. Keep going on Banca team. Thank you for immediate response on each stage of process. Kudos the whole team.

Timothy Vargas

UI/UX Designer

Sandra Hughes

UI/UX Designer

Zachary Taylo

Web Developer

Linda Lawrence

UI/UX DesignerThere are different types of loan products which loan disbursement amount can vary ranging from 10000 ETB to 300000 ETB

The requirements to get a loan are credit score, income and employment, debt-to-income ratio, collateral, loan purpose, loan amount and term, citizenship or residence, age, and financial history.

The time it takes for a loan to be disbursed by our institution can vary depending on several factors, including the specific processes, loan amount, documentation requirements, and the borrower's readiness to fulfill those requirements. Some general factors like Application Processing Time, Document Submission and Verification, Loan Approval and Agreement, Collateral Evaluation (if applicable, Disbursement Method, Borrower Readiness.

To reduce the cost of your loans our institution you may need to Improve your creditworthiness, compare interest rates and fees, seek out subsidized programs, develop a positive relationship, etc.

When you become our customer by making an initial deposit of 100 ETB for the account opening book, you unlock a range of benefits. You gain access to various loan options with highly competitive monthly interest rates and the opportunity to open different types of savings accounts that offer attractive interest rates.

You will repay the loan you have taken according to the terms agreed upon at the time of disbursement. The repayment schedule begins from the month immediately following the disbursement and collection will be made at the end of each month until the loan dispersed fully paid up.

The loan repayment period will vary depending on the specific loan products you choose from our offerings. It is also influenced by your personal preferences and your ability to comfortably repay the loan.

Certainly! We provide you with the flexibility to repay and close your loan at any time. Once you decide to do so, you can initiate the loan redemption process and begin a new loan application whenever you desire.

To make changes to your loan application after submission in our institution depends on the specific policies and procedures. Making changes after submission may not always be possible or may be subject to certain limitations like timing, our policies, communication with our staff

To provide effective and efficient financial and related services to the unbanked micro and small enterprises, farmers with a focus on women